Invoicing, bills, receipts, SAF-T files, KSeF

Invoicing software COMPLIANT WITH NEW REGULATIONS FOR 2024/2025

Faktura VAT 2026 START Program

Intuitive and fast operation of the application with a mouse or keyboard.

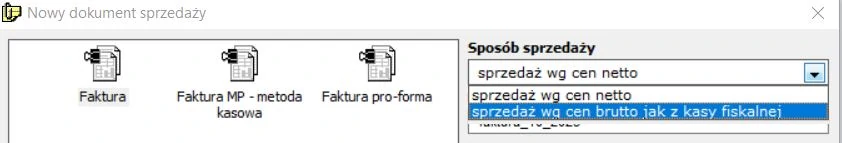

Invoice software allows you to create such documents as:

- Faktura VAT (for VAT payers) and Non-Faktura VAT (for non-VAT payers)

- Margin invoice

- MP invoice – Small taxpayer

- RR invoice – Flat rate farmer

- WDT invoice – Intra-Community Delivery of Goods.

- WNT invoice – Intra-Community acquisition of goods

- Internal invoice

- Export invoice

- Correction invoice

- Scrap Invoice

- Reinvoice

- Account

- Paragon

- Pro-forma documents

- Advance payment invoice

- Final invoice

- Commercial Invoice

- Commercial Invoice pro-forma

- Order for customers

- Order for suppliers

- Offer to customer

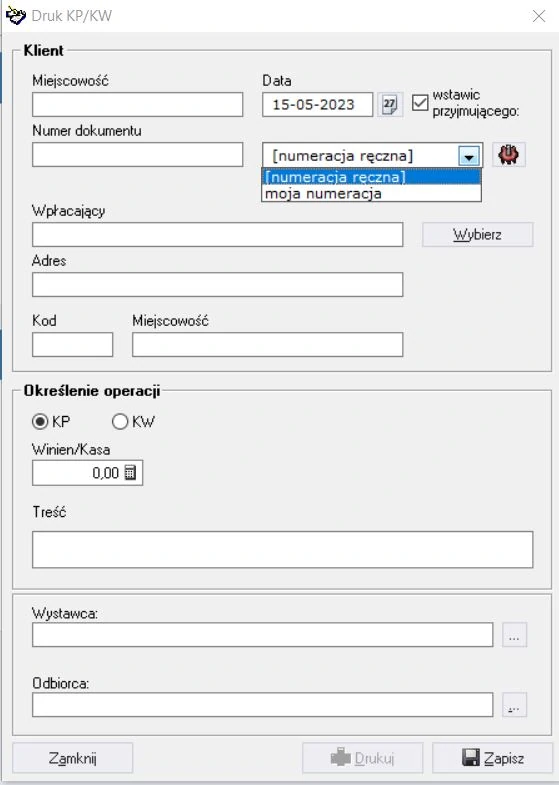

- KP/KW document

- Cash report

- Transfers (color or print)

- Social Security payments

- Payment register

- Calls for payment

- Proofs of payment

- Correction note

- VAT records and Sales report

Program features

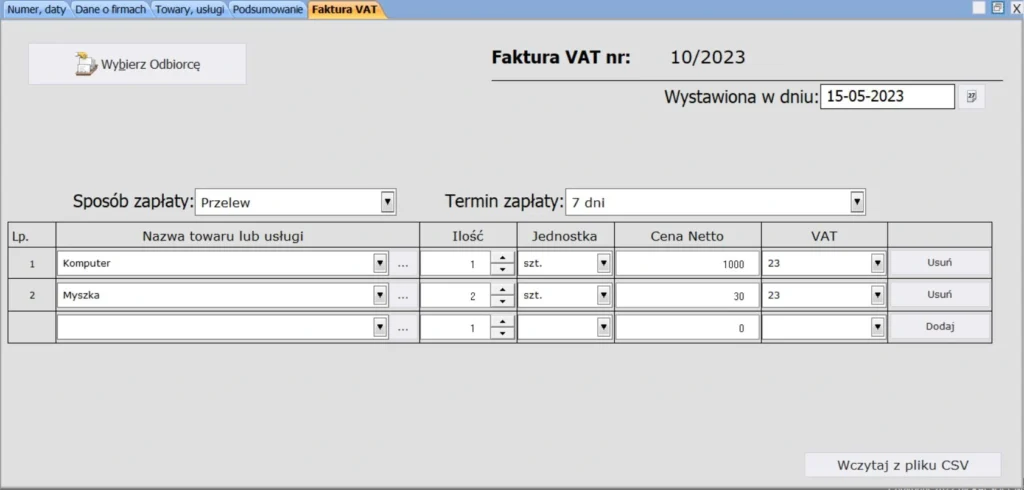

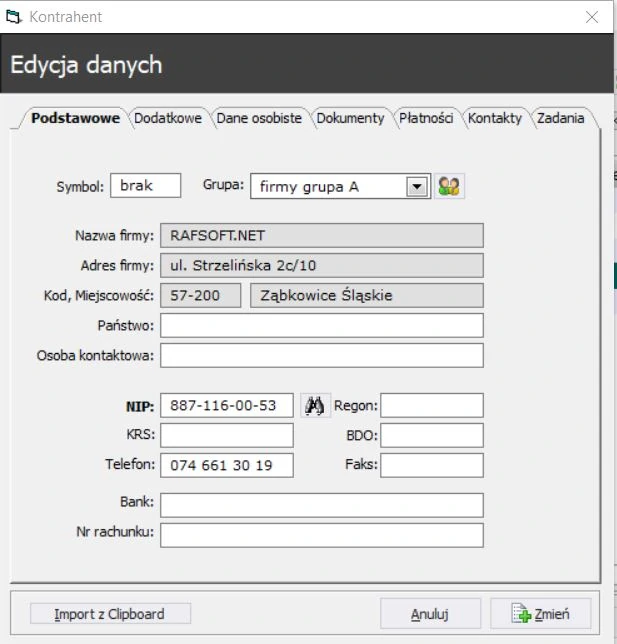

Quick invo icing – our invoicing software allows you to create documents quickly by automatically loading contractor data, items from price lists and default settings. It has a built-in search engine for companies from the online database of the Central Statistical Office (GUS), insertion by Tax ID number from the list of companies after entering part of the name, auto-complete fields with the names of localities by postal codes, quick selection of goods/services from a ready-made list. This makes invoice data entry smooth and fast. The VAT Faktura VAT 2026 START invoicing program allows you to prepare a ready-made sales document in a matter of seconds.

Keyboard shortcuts, automatic building of price list and company list. Ability to clone documents previously issued. Sales can be made on the basis of net or gross prices.

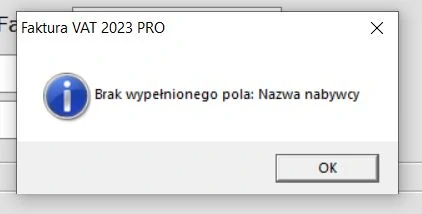

Verification of the document before printing it checking the correctness of account numbers, NIP, REGON (can be disabled), postal codes, checking the entered data of the seller, buyer and items.

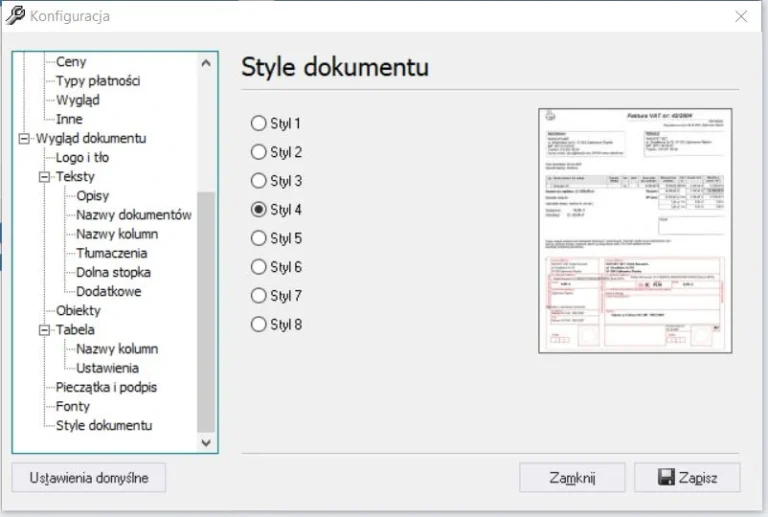

Defining the appearance of the invoice. Our invoice software gives you 7 professional ready-made invoice templates into which you can insert your logo, company stamp, your own notes, edit text and edit document headers. It is possible to insert a custom footer with description, notes under the invoice content, above the item table and change the font.

Configuring the displayed columns in the invoice item table. Subscription invoices, we have the ability to print invoices simultaneously with the transfer printout attached at the bottom and automatically filled in on one A4 sheet.

Custom numbering of documents according to your own format, e.g. SYMBOL/NR/ROK/F, automatic or manual. Annual or monthly numbering. Invoice software Faktura VAT 2023 START allows separate numbering for different documents.

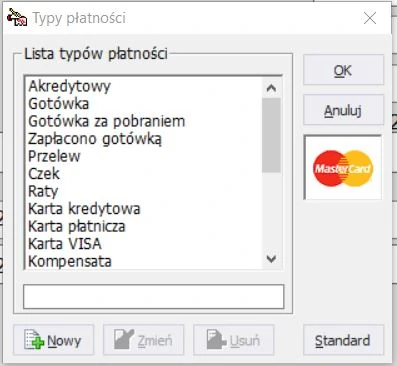

Custom dictionaries, definition of units of measurement, payment methods, list of bank account numbers, groups of goods, groups of customers, ability to configure VAT rates.

Ability to save documents to popular PDF, HTML, JPG, XML formats and send by email. Sending the document by email, ( also serially simultaneously to several hundred recipients or at the time of printing). You have the option to print documents at the end of the month or from a selected period.

More opportunities

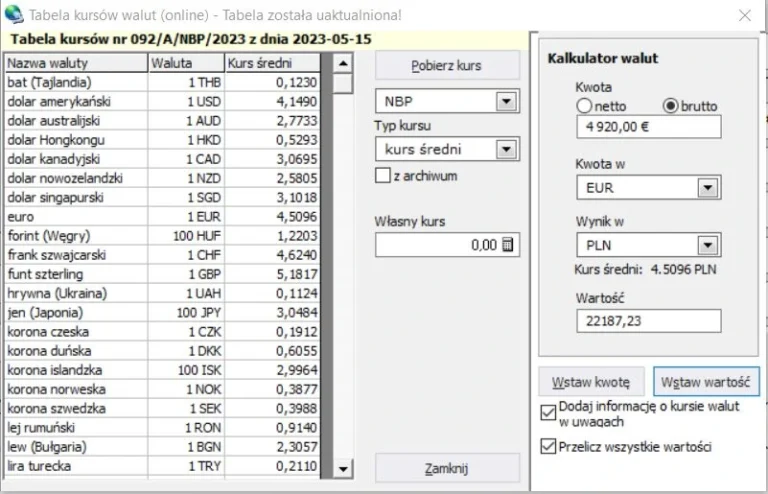

Our invoicing software allows you to issue documents in the following languages: English, German, Czech, French, Swedish, and it is possible to add/edit your own translations. Bilingual invoices with translation on the same page or in the language of your choice. Handling sales in different currencies. Downloading exchange rates from the National Bank of Poland. Convert invoices in any currency to other currencies.

The software automatically downloads the current exchange rates from the Internet (NBP) and the ECB and converts them according to the currency calculator. You get access to archival exchange rates from the National Bank of Poland and the ECB, the program converts the values of the document into any other currency with the appropriate annotation on the document for. NBP rate and table number.

We can print the price list and the list of companies, as well as freely export and import from SQL databases, CSV, Excel, HTML as well as XML text files. We can also print the price list as a web page.

Company and commodity names can be any length, defined according to three levels of commodity prices (Basic, Wholesale, Sale). The data in the goods and company databases are collected automatically by the invoicing program when creating documents ( we can disable this option). The search for goods and companies is instantaneous, as they are identified by their VAT number, abbreviations, indexes and names. We also have the ability to give discounts by assigning individual discounts to a particular customer.

Additional features

A useful option is the function of reports (sales, VAT records) – thanks to which we can easily create sales records for VAT or monthly posting in the income-revenue book, analyze the development of our company, or observe changes in sales.

The reporting module facilitates balancing sales and purchases by our contractors, goods by any currency and any time period. Faktura VAT 2026 START gives you full control of receivables, keeping a register of payments and the ability to settle selected invoices of a given contractor. Unpaid invoices are highlighted in red, and you can send email reminders and print summonses.

Cash report, KP and KW forms with custom-defined numbering.

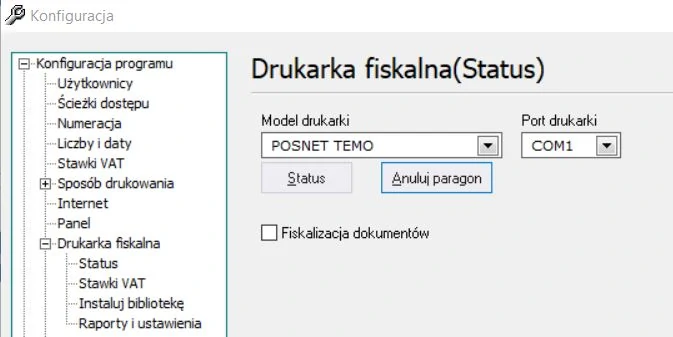

Invoice program Faktura VAT 2020 works with barcode readers and fiscal printers working with posnet thermal communication protocol i.e. POSNET THERMAL, and NOVITUS, QUATRO, DELIO or VIVO printers. Cooperation with Elzab and Novitus cash registers.

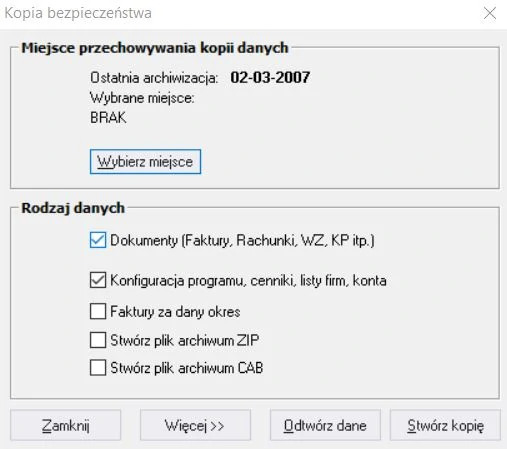

Backup; The invoice program gives you the ability to create copies of the documents and data you enter on the media and ZIP of your choice. It will remind you of its performance on its own. A practical and indispensable feature when your computer equipment crashes.

Automatic update. The invoicing program automatically updates itself via the Internet. When regulatory changes are made or when an upgrade occurs, the application will detect the availability of a newer version and download the update to your computer.

Work remotely via the Internet or on a local network. You can work remotely based on the local l remote database server MS SQL, MySQL. All employees of your company can use the same data, documents remotely over the Internet or from a selected position on the local network.

Invoicing software – hardware requirements

System requirements: Windows 7, Windows 8, Windows 10 Windows 11, Mac OS (optional)*.

Support for printers: inkjet, laser, dot matrix

Cooperation with fiscal printers: POSNET, NOVITUS, ELZAB

Operation of fiscal cash registers: NOVITUS, ELZAB

Barcode reader support: YES

Unlimited Seat License: Price: 99 złfrom ‘ gross/year, Free updates and technical support for 1 year. Buy the program![]()

![Invoicing software - [product_name] START Invoicing software - Faktura VAT 2025 START](https://ksiegowosc24.pl/wp-content/uploads/2014/01/faktura-vat-start.webp)

Reviews

There are no reviews yet.